What Is Uninsured and Underinsured Motorist Coverage?

Get the coverage you need when an at-fault driver doesn't have suitable car insurance.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

While car insurance is required for drivers in nearly every state, some people still drive without insurance, putting everyone else on the road financially at risk. The most recent figures state that around 14% of all drivers in the U.S. are uninsured. If you get into an accident with another driver who's at fault but doesn't carry any or enough car insurance of their own, you could be stuck covering your own expenses. But if you have uninsured or underinsured motorist coverage, you can still get the reimbursement you deserve in this situation.

An independent insurance agent can help you find all the uninsured or underinsured motorist coverage you need. They'll help you get the right car insurance policy that contains the best coverage for your needs and budget.

What Is Uninsured Motorist Coverage?

Uninsured motorist (UM) coverage covers your expenses if you are in a car accident where the at-fault driver does not have car insurance. It also applies after hit-and-run incidents when there's not even an opportunity to ask for the other driver's insurance information.

UM is required by law in some states and optional in others. Where it's required, the state will usually prescribe minimum coverage limits that you must carry.

When would uninsured motorist coverage apply?

If you were the victim of a hit-and-run or an accident with a driver who didn't have car insurance to cover your expenses, uninsured motorist coverage would kick in. Uninsured motorist insurance covers you and any passengers in your car for the following:

- Medical bills

- Lost wages

- Bills related to any pain and suffering

- Physical damage to your vehicle or other property

An independent insurance agent can further explain when you'd need to use uninsured motorist coverage to get compensated.

What Is Underinsured Motorist Coverage?

Underinsured motorist coverage (UIM) is very similar to uninsured motorist coverage. Underinsured motorist coverage kicks in when the at-fault driver in an accident did have some car insurance of their own, but not a high enough amount to fully compensate the other driver for all the bodily injury or property damage they're responsible for.

How your underinsured motorist coverage works may depend on your state. In most cases, "underinsured" is defined as an at-fault driver who doesn't have enough insurance to cover someone else's damages. The driver might have either insufficient liability limits to cover your bills or liability limits that are less than or equal to your underinsured motorist coverage limit.

What’s the Difference Between Uninsured and Underinsured Motorist Coverage?

Here's a breakdown of the difference between uninsured and underinsured motorist coverage:

- Uninsured motorist coverage: When an at-fault driver doesn’t have any coverage at the time of an accident.

- Underinsured motorist coverage: When the at-fault driver has insurance but doesn’t have enough coverage to pay for all the victim's expenses that they're responsible for after the accident.

An independent insurance agent can further explain the difference between uninsured and underinsured motorist coverage.

What Are the Two Kinds of Uninsured or Underinsured Car Insurance?

There are two types of uninsured and underinsured motorist coverage:

- Uninsured/underinsured motorist bodily injury coverage (UMBI/UIMBI): Covers bodily injury for you and your passengers if the at-fault driver has no insurance or does not have enough insurance to cover your expenses. This coverage is essential to making you whole after an accident, even if you have medical payments coverage or personal injury protection (which cover medical expenses for you and your passengers, regardless of fault).

- Uninsured/underinsured motorist property damage coverage (UMPD/UIMPD): Reimburses you if your car or other property gets damaged by an uninsured or underinsured driver who cannot fully compensate you for the repairs.

Sometimes, UM and UIM pay for rental cars or the cost of your collision coverage deductible, depending on your policy. Make sure to enlist the help of an independent insurance agent to make sure you understand how your uninsured and underinsured motorist coverages work.

Is Uninsured Motorist Coverage Required?

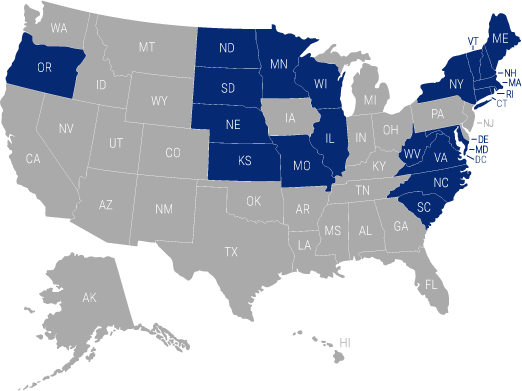

States where uninsured motorist coverage is required with standard auto policies:

Uninsured motorist coverage is not required by law in many other states. If you live in a state that doesn’t require uninsured motorist coverage, it's still a good idea to add it to your car insurance policy.

Do I Need Uninsured or Underinsured Motorist Coverage?

Not only does uninsured or underinsured motorist coverage protect you if you get hit by an uninsured or underinsured driver, but it will also help pay for medical costs, pain and suffering, and lost wages associated with the accident.

In addition, not every state is created equal when it comes to uninsured and underinsured drivers. Some states have more uninsured or underinsured drivers than others, and knowing who you're sharing the road with could sway your decision about whether to add the coverage.

States with the highest percentage of uninsured drivers

| Rank | State | Percent Uninsured |

|---|---|---|

| 1 | Washington, DC | 25.2% |

| 2 | New Mexico | 24.9% |

| 3 | Mississippi | 22.2% |

| 4 | Tennessee | 20.9% |

| 5 | Michigan | 19.6% |

| 6 | Kentucky | 18.7% |

| 7 | Georgia | 18.1% |

| 8 | Delaware | 18.1% |

| 9 | Colorado | 17.5% |

| 10 | Ohio | 17.1% |

If you live in one of these states, it's important to consider adding uninsured motorist coverage to your car insurance policy.

How Much Uninsured or Underinsured Motorist Coverage Do I Need?

If you live in a state where uninsured motorist coverage is required by law, your insurance company may automatically add the required amount of coverage to your auto policy. If it’s not required or you want to add to the minimum, it’s recommended to have at least $100,000 per person and $300,000 per accident. An independent insurance agent can help advise you on the exact amount of coverage that's right for you.

What Does Uninsured or Underinsured Motorist Coverage Cover?

Whether you get in an accident with an uninsured or an underinsured driver, uninsured or underinsured motorist coverage will help pay for a number of expenses to get you back on the road. This coverage can pay for the following:

- Property damage repair to your own vehicle

- Other property damage besides your vehicle

- Medical expenses of your family members if they get harmed by an uninsured motorist

- Lost wages and/or lost earning ability

- Nonfinancial costs such as pain and suffering

In most instances, uninsured or underinsured motorist coverage should cover a hit-and-run, but your insurance company will evaluate this on a case-by-case basis.

How Does Uninsured or Underinsured Motorist Coverage Work?

Uninsured or underinsured motorist coverage works by reimbursing you for damages that an at-fault driver can't cover. Suppose you're in an accident where the at-fault driver flees the scene or isn't able to reimburse you adequately for his or her share of the damages. In that case, you'd file a claim with your own car insurance policy, and your uninsured or underinsured motorist coverage would help you recoup your losses.

How Much Does Uninsured or Underinsured Motorist Coverage Cost?

The cost for adding uninsured and underinsured motorist coverage to your car insurance policy is relatively low. However, if you live in a state with a higher number of uninsured drivers, you can expect to pay more for it than you would in other states.

Do I Need Uninsured or Underinsured Motorist Coverage If I Have Health Insurance?

Yes. Uninsured or underinsured motorist bodily injury coverage can pay for things that your health insurance does not, such as lost wages. It can also help you cover your health insurance deductible. It might also cover services like acupuncture and chiropractor visits that may not be covered under your health insurance plan.

What Is Non-Stacked Uninsured or Underinsured Motorist Coverage?

Non-stacked or unstacked insurance disallows drivers from combining coverage from multiple cars or car insurance policies to increase their total limit of coverage. Non-stacked uninsured or underinsured motorist coverage limits your total coverage limit to that of just the policy for the vehicle involved in the incident. An independent insurance agent can help further explain the differences between non-stacked and stacked uninsured or underinsured motorist coverage.

How an Independent Insurance Agent Can Help You Find Uninsured Motorist Coverage

An independent insurance agent can help you determine the right amount of uninsured and underinsured motorist coverage to add to your policy. Your agent will walk you through a handpicked selection of the best policy options for you. Not only that, they’ll cut the jargon and clarify the fine print so you know exactly what you’re getting when it comes to car insurance, uninsured or underinsured motorist coverage, or anything else.

https://www.nerdwallet.com/article/insurance/uninsured-motorist-coverage

https://www.bankrate.com/insurance/car/uninsured-motorist-statistics/#how-to-protect-yourself-from-uninsured-motorists

https://www.insurance-research.org/sites/default/files/IRC%20Uninsured%20Motorists%20Summary%20Page.pdf

https://www.iii.org/fact-statistic/facts-statistics-uninsured-motorists